Story Highlight: Pakistan, a South Asian nation, is requesting a bailout from the IMF once more which has already happened in the past for more than 20 times.

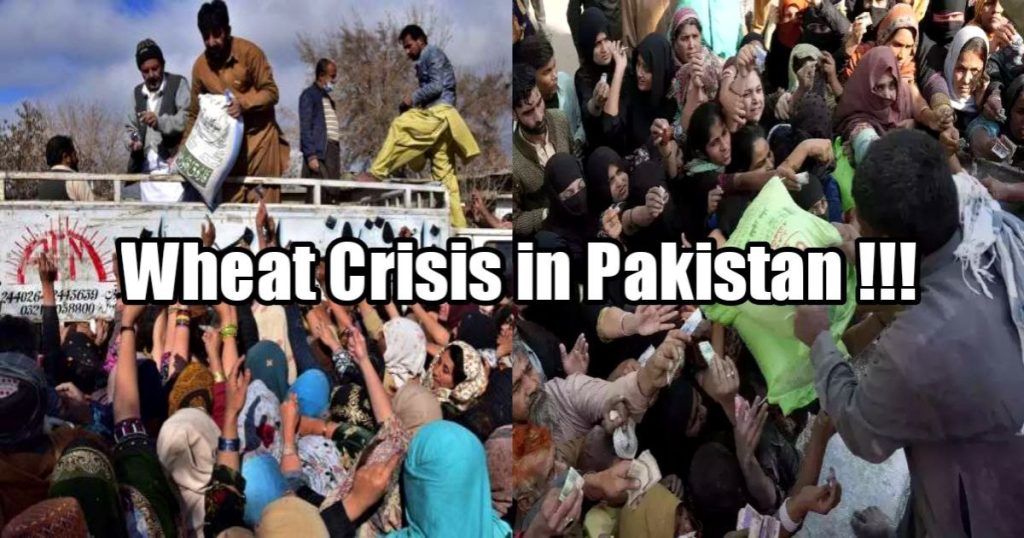

As inflation reaches a 48-year high, people of Pakistan are crushed while attempting to purchase subsidized food and experience the nationwide blackout caused by electricity outages.

Pakistan is seeing its greatest economic disaster in decades and is at the verge of sovereign debt default, mirroring the collapse of Ghana and Sri Lanka but unfolding in a nuclear-armed country with one of the largest populations in the world.

As foreign reserves sink, which now only cover three weeks of imports. In the next few days, it won’t be shocking if Pakistan is forced into civil conflict due to its impending sovereign debt default and extreme inflation.

What is Sovereign Debt Default?

When a government/nation fails to meet any or all of its debt obligations to its creditors, who are usually other nations or international organizations, this is known as a sovereign debt default.

Also Read| Aadi Mahotsav 2023: About National Tribal Festival, Theme, Significance, and “Shree Anna”

Why Do Countries Default on Sovereign Debt?

Many factors, such as economic instability, political instability, or excessive debt levels, may contribute to this.

Generally speaking, defaulting on sovereign debt is the last choice since it can affect the economy and society long-term.

Factors Causing Default on Sovereign Debt

The factors that lead to a country’s sovereign debt default are intricate and varied, and they can change based on the nation’s unique political and economic circumstances.

High debt-to-GDP ratios, political unrest, economic crises, shaky institutions, and external shocks like natural catastrophes or changes in the state of the world economy are some typical causes of sovereign debt defaults.

Poor public financial management, such as excessive borrowing and corruption, can also increase a nation’s susceptibility to default. Under some circumstances, a government may choose to prioritize domestic spending above the payment of international debts, which would result in a default.

Also Read| BAFTA Award 2023: All Quiet on the Western Front made the History

Consequences of Defaulting on Sovereign Debt

A sovereign debt default, which happens when a nation misses a payment on a loan or interest, can harm the afflicted nation and the world economy too.

Loss of credibility and faith in the nation’s capacity to manage its finances is one of the main effects, which raises borrowing rates and discourages foreign investment. A vicious cycle of greater debt levels and slower economic development may result from this.

In addition, governments may need to enact austerity measures or reduce public expenditure to manage their debts, which can cause social and political turmoil. In severe circumstances, this might even result in political instability and further worsen poverty and inequality.

The effects of a sovereign debt default may be severe and widespread, impacting not just the distressed nation but also the larger global financial system.

Also Read| India ready to contribute to any peace process for resolving Ukraine crisis, says PM Modi

Role Of the International Monetary Fund (IMF) in Sovereign Debt Crisis

To lessen the effects of a sovereign debt default, the International Monetary Fund (IMF) is a crucial player which comes to the rescue at the forefront. These organizations can offer financial aid and policy recommendations in times of crisis to assist nations in managing their debt and reestablishing economic stability.

IMF bailouts focus mainly on fiscal consolidation and frequently have stringent requirements attached, such as enacting structural changes or lowering public spending, to address the root causes of the crisis and avoid further defaults.

While the assistance of the IMF can be essential in preventing a full-blown financial and economic catastrophe, some claim that the restrictions tied to these bailouts occasionally worsen social and economic inequalities in the affected nations. Yet, its function in controlling national debt defaults continues to be a crucial weapon for advancing world economic stability.

Also Read| Pakistan: History of Lending Commitments

List Of Recent Sovereign Debt Default Nations

The most recent sovereign/countries’ defaults are listed here along with the reasons behind them:

Sri Lanka (2022): Sri Lanka announced its bankruptcy and potential sovereign debt payment default at the beginning of 2022.

Due to the macroeconomic effects of the covid 19 pandemic and its impact on the tourism sector, poor government policy regarding organic farming, China’s debt trap diplomacy, the impact of the Ukraine-Russia war, which has exacerbated the food and fuel crisis, the country experienced its worst humanitarian disaster and widespread civil unrest in the months that followed.

Also Read| Sri Lanka’s debt limbo

Venezuela (2020): Venezuela’s default on its national debt was caused by a political and economic crisis, a drop in oil prices, and US sanctions.

Lebanon (2020): The country defaulted on its foreign currency sovereign debt due to economic catastrophe, political unrest, and high amounts of public debt.

Argentina (2020): The country’s default on its foreign-currency sovereign debt was caused by high inflation, recession, and political unrest.

Ecuador (2020): The country’s sovereign debt was not repaid due to the economic slump and declining oil prices.

Belize (2020): Debt restructuring talks fell, resulting in the country’s default on its sovereign debt.

Lebanon (2019): Lebanon’s default on its national debt was caused by an economic crisis and unsustainable amounts of government debt.

Argentina (2014): Due to a protracted debt battle with its creditors, Argentina defaulted on its foreign currency sovereign debt.

Belize (2012): The country’s default on its sovereign debt was caused by fiscal mismanagement and large amounts of public debt.

Greece (2012): The country defaulted on its foreign-currency sovereign debt due to high levels of public debt and an ongoing economic crisis.

Jamaica (2010): An economic downturn, high levels of public debt, and structural issues caused the country to default on its sovereign debt.

Pakistan Sovereign Debt Crisis

Poorer people Of Pakistan are suffering the brunt of the inflationary pressures from Karachi to Lahore. Terrorism and political unrest are exacerbating the nation’s issues.

Along with the military’s historic control over the country’s politics, the administration is preoccupied with its protracted fight with ousted PM Imran Khan.

A climatic crisis has further complicated conditions in the nation. Over a third of the country was submerged by floods last summer, which resulted in more than 1,700 fatalities, millions of displaced people, and a 50% reduction in economic growth.

Repeated balance-of-payment crises have been brought on by an overreliance on imports and a meager dollar inflow. The country has also accumulated mountains of debt that have failed to create foreign reserves and relies on Chinese financing to develop projects like power plants in general and the CPEC project specifically, which have failed to raise slow export numbers.

Also Read| Pakistan likely to go the Sri Lanka way, default on external debt payments

Given Pakistan’s estimated $240 billion total debt, the IMF’s offer is still only a few pence. Fitch Ratings has lowered the country’s credit ratings twice in four months, and long-term dollar bonds are trading at distressed levels.

According to IMF data, from 2006 to 2020, China’s proportion of the world’s poorer countries’ foreign debt increased from 2% to 18%, making it the largest sovereign creditor to developing nations.

With high external and public debt levels, a growing current account deficit, and a faltering economy, Pakistan is experiencing the worst sovereign debt crisis.

Comments 1