Kaynes Technology India Limited (KTIL) has launched its initial public offering (IPO) today (November 10). Does it excite you???

IPO has been a decorated and glorified buzzword in the domain of the stock market. Let’s understand IPO, whether it has anything substantial or just overhyped euphoria created around it, and its brief history.

Several factors are involved in building a brand, but trust is the most crucial one. When a brand owner can expand their business with the support of a consumer base and trust, that is when it needs support financially and emotionally. This brings us to the topic of initial public offerings.

“India has an incredible investment opportunity and a significant part of the eCommerce and digitalization growth story in emerging and frontier economies outside China,” EMQQ Global founder and CIO Kevin T. Carter said.

How Things Work

An initial public offering (IPO) is when a business, whether new or established, decides to offer its shares to the public (Primary market) without first listing them on a stock exchange to raise the fund for business expansion, purchase of new equipment, real estate, or to pay off loans and debts. People who invest in a firm by purchasing its shares are compensated (as dividends) by the company or can sell the shares in the stock market (Secondary Market) at a price that is advantageous for trading the shares with help of brokers.

Need To Know Before Applying For IPO

Learn everything you can about the firm before applying for an IPO. Also, don’t forget to study the Company’s prospectus, which is readily available on both the SEBI and the company’s websites. The financials of the company, its track record in the market, and the reason for the IPO in India are all thoroughly covered in this document. Additionally, see if any significant lawsuits are pending against the promoter or the business. Always stay away from repeat offenders.

When evaluating an IPO for a new company, consider the return on equity, price-to-earnings ratio, and price-to-book ratio. This is by far the most crucial consideration to keep in mind and the most challenging for novice investors to ascertain.

One of the main factors that might ruin any company’s IPO show is the general weakness in the equity market, excessive valuations, consistent losses in the most recent fiscal years, anticipated fierce competition, and lower-than-expected subscription to its IPO.

Avoid Oversubscription

Each IPO has a predetermined, limited number of shares that are proportionately distributed to each investment type. If there is strong interest in a specific IPO, applications may exceed the shares listed. In these circumstances, the registrar will hold a lottery to distribute shares to the applicants.

Learnings from India’s two overhyped and largest IPOs launches. The first one was the state-owned Life Insurance Corporation (LIC) which raised a record ₹20,557 crores via the offer but disappointed investors and is currently trading 38% below the IPO price.

Paytm, formally known as One 97 Communications registered the biggest-ever fall in a decade for any IPO on a listing day, as the stock crashed 27.25 percent.

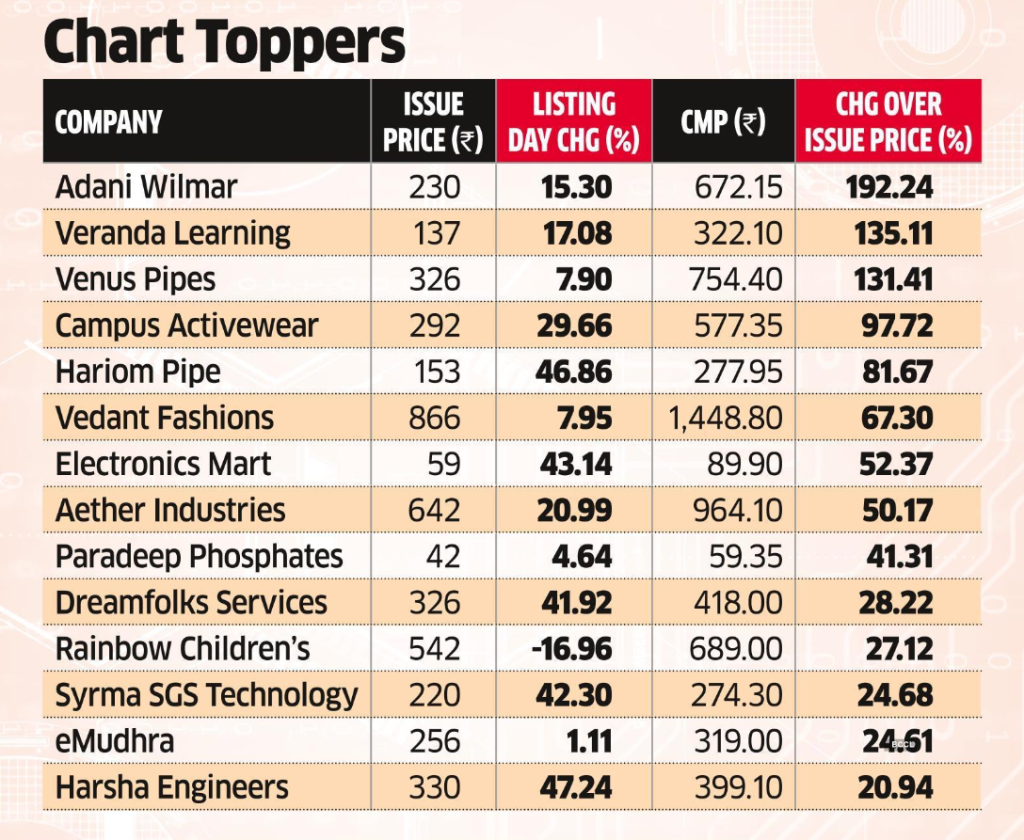

However, Adani Wilmar Ltd., a joint venture between Gautam Adani’s company and Singapore’s Wilmar International Ltd., has outperformed 121 Asian IPOs valued at more than $100 million in 2022 and has nearly tripled since its debut.

Is It the Right Time To Get Tuned With Start-Ups?

A large number of startups in India are preparing to go public. Based on information from Prime Database, Nikkei Asia reports that 20 companies have raised a total of around 433 billion rupees ($5.27 billion) through IPOs in India during the first eight months of this year. In contrast, over the course of 2021, 63 firms raised 1.18 trillion rupees.

Additionally, other prominent Indian Startups, including the food delivery service Swiggy, the personal care company Mamaearth, the furniture store Pepperfry, and the retailer of baby products FirstCry, have started preparing for initial public offerings (IPOs).

Among the noteworthy startups that have recently submitted offer documents are insurance provider Digit and home healthcare firm Portea.

Where Does the Indian Stock Market Stand Globally?

The Indian stock market has performed better than many of its international competitors. Since July, India’s benchmark Sensex stock index has increased by 8%. At the same time, the Shanghai Composite Index sank 8.6%, the Hang Seng Index in Hong Kong fell 18%, and the Nikkei 225 in Japan increased just 2.45%.

IPO history

For decades, the term initial public offering (IPO) has been a buzzword on the stock exchange and among investors. The Dutch are credited with performing the first modern IPO by selling shares of the Dutch East India Company to the general public.

Since then, firms have utilized IPOs as a means of raising funds from the general public by issuing shares of stock to the general public.

The financial crisis of 2008 caused a year with the fewest IPOs ever. While in recent times, the majority of the IPO hype has shifted to so-called unicorns, startup businesses with valuations of $1 billion and above.

Upcoming IPOs (BSE & NSE)

The IPO of several prominent firms is scheduled for November. A list of forthcoming IPOs is shown below:

| Name of the company | Size of IPO (approx.) | Expected IPO Date |

| Kaynes Technology India IPO | ₹857.82 cr | 10 Nov – 14 Nov 2022 |

| Archean Chemical IPO | ₹ 1,462.31 | 9 Nov – 11 Nov 2022 |

| Five Star Business Finance IPO | ₹1960.01 cr | 9 Nov – 11 Nov 2022 |

| INOX Green Energy IPO | ₹740 cr | 11 Nov – 15 Nov 2022 |

| Aadhar Housing Finance | ₹7300 cr | Nov |

| Snapdeal IPO | ₹1250 cr fresh issue | Nov |

| Inox Green Energy Services IPO | ₹740 cr | Nov |

| OYO IPO | ₹8430 cr | Nov |

| Navi Technologies Ltd IPO | ₹3350 cr | Nov |

| Penna Cements Ltd IPO | ₹1550 cr | Nov |

An IPO is an important step in the growth of a business and its credibility. Indeed, a large number of IPOs is a sign of a healthy stock market and economy.

Wahh…got a vast knowledge about IPO.